The latest research report from Counterpoint’s IoT service informs that the TWS (Truly Wireless Earbuds) market in India has registered a sturdy growth of 66% year-on-year in the first quarter of 2021. As a matter of fact, the significantly stronger growth came on the back of a strong value proposition offered by local brands outperforming the Chinese manufacturers. Moreover, the increase in the number of celebrity endorsements and domestic manufacturing of the products also helped in surging the demand.

The Indian TWS Market

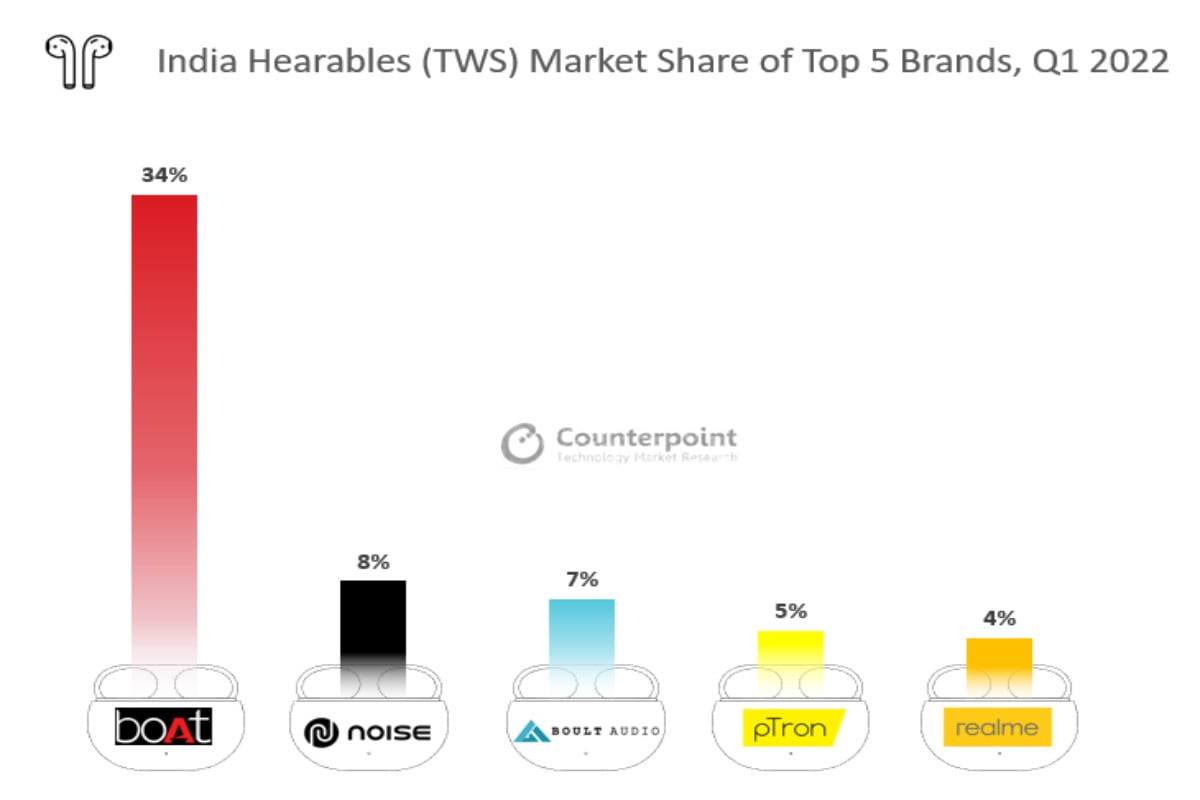

The senior research analyst Anshika Jain in a statement said that Indian brands managed to take over 72% of the total market share in India as their shipments more than doubled in the first quarter of 2022. She added that the top four positions were taken by India-based brands which captured more than half of the total TWS market. She informed that Indian brands put more emphasis on targeting the low-price tier which is under Rs 2,000. Anshika Jain stated that there was an overall YoY decline of 19% in ASP in Q1 2022 because of the growing emphasis on domestic manufacturing. She said that it is very likely that the brands will push to release more made in India products in the second half of this year as well. One of the leading brands in India – Boat is expected to manufacture more than half of its products in India. Other notable brands such as Noise and Realme will also focus on launching locally manufactured products in the first half of 2022 itself. Liz Lee – a senior research analyst talked about the growth of the premium segment in the TWS market informing that the premium segment which accounts for the price range above Rs 5,000 registered 53% YoY growth in Q1 2022 led by Apple, Samsung and Sony. She added that Apple and Samsung shipments remained strong because of the loyal customer base whereas Sony became the fastest growing brand in the premium segment because of the two newly launched devices. Apart from these, the first quarter saw some emerging brands in the TWS market in India as well. India’s own brand Mivi maintained a position in the top 10 list due to its focus on domestic manufacturing. Oppo on the other hand grew 365% YoY due to the good performance of its low-priced model. Airpods 3 helped Apple get the top spot in the premium segment while Nothing maintained a position within the top five premium brands due to its competitive pricing and innovative design.